Ctc Calendar 2026 Irs.gov Conclusive Consequent Certain. In 2026, the earned income threshold will be $3,000 regardless of the number of children for which the ctc is claimed. Income thresholds determine how much a taxpayer could earn for the year before they no longer qualify for the ctc.

The child tax credit (ctc) and additional child tax credit (actc) are credits for individuals who claim a child as a dependent if. Ctc payments 2026 schedule brings innovative changes to the way families receive financial assistance through the child. You can claim the child tax credit by entering your children and other dependents on form 1040, u.s.

Source: ctc.cbe.ab.ca

Source: ctc.cbe.ab.ca

20252026 School Calendar Available Key changes to the child tax credit (ctc) the child tax credit (ctc) will be $2,200 per qualifying child for the 2025 tax year. Ctc payments 2026 schedule brings innovative changes to the way families receive financial assistance through the child.

Source: metabetageek.com

Source: metabetageek.com

Free 2026 Yearly Calendar Printable Plan Ahead! Printables for Everyone The child tax credit (ctc) and additional child tax credit (actc) are credits for individuals who claim a child as a dependent if. Ctc payments 2026 schedule brings innovative changes to the way families receive financial assistance through the child.

Source: doreneycornelia.pages.dev

Source: doreneycornelia.pages.dev

Ctc Calendar 2025 Irs Pdf Saba Roxine Ctc payments 2026 schedule brings innovative changes to the way families receive financial assistance through the child. In 2026, the earned income threshold will be $3,000 regardless of the number of children for which the ctc is claimed.

Source: ataglance.randstad.com

Source: ataglance.randstad.com

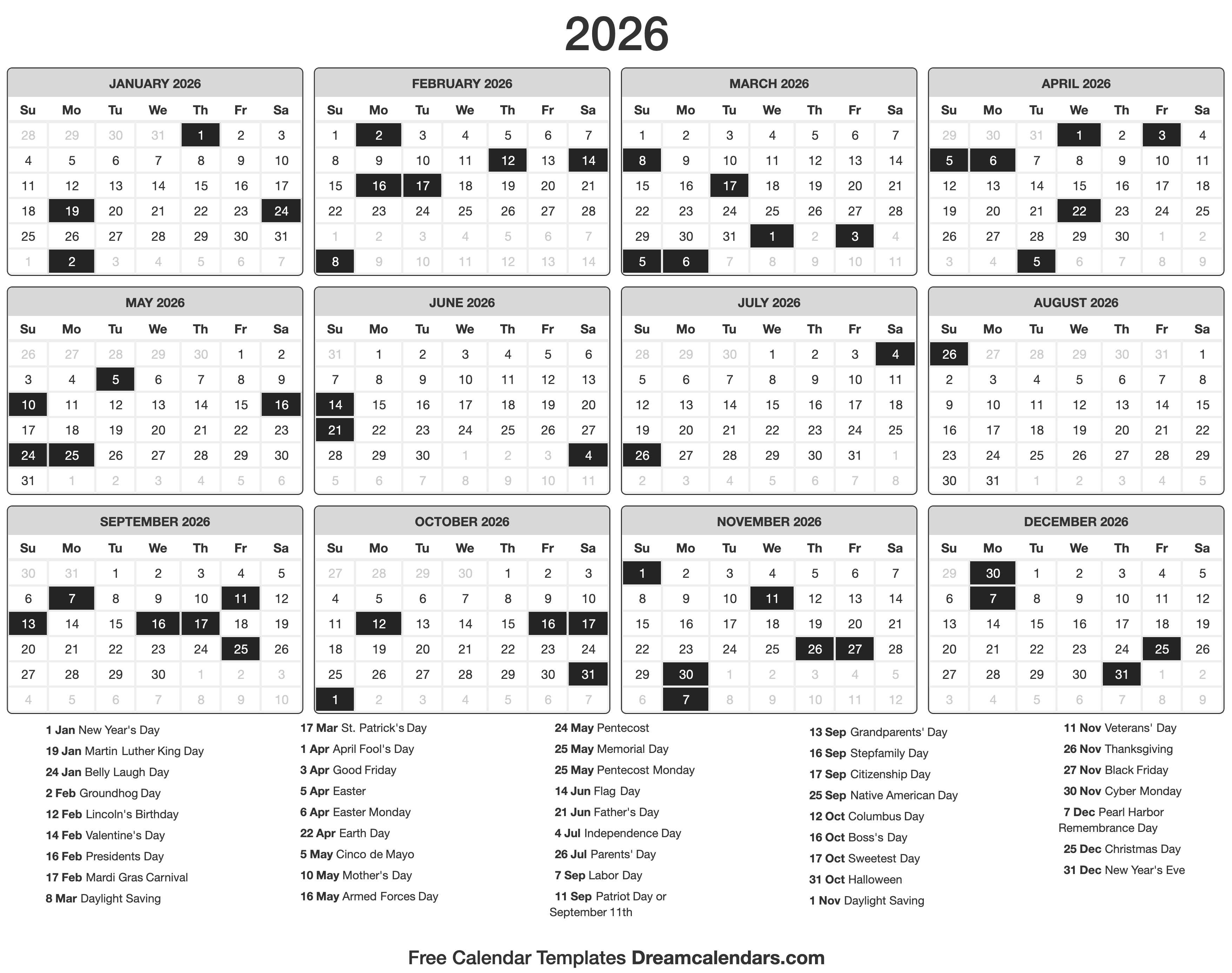

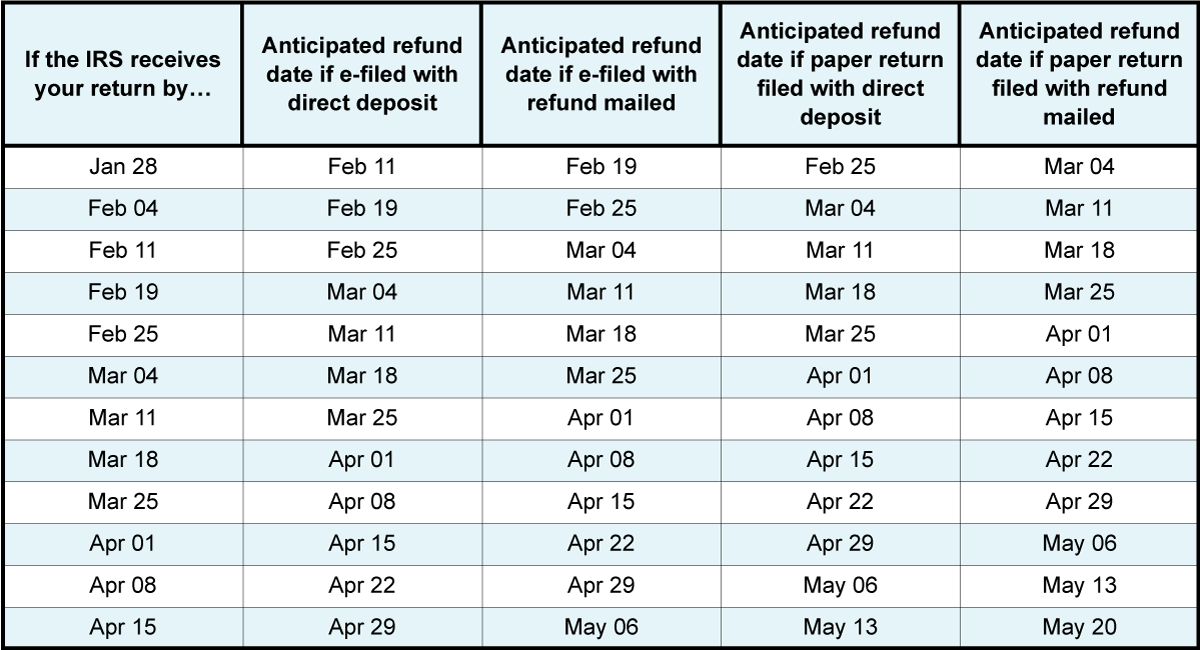

Irs Direct Deposit Calendar Printable Calendars AT A GLANCE Ctc payments 2026 schedule brings innovative changes to the way families receive financial assistance through the child. In 2026, the earned income threshold will be $3,000 regardless of the number of children for which the ctc is claimed.

Source: arturowhonore.pages.dev

Source: arturowhonore.pages.dev

Irs Tax Return Calendar Arturo W. Honore In 2026, the earned income threshold will be $3,000 regardless of the number of children for which the ctc is claimed. Ctc payments 2026 schedule brings innovative changes to the way families receive financial assistance through the child.

Source: thersajakers.pages.dev

Source: thersajakers.pages.dev

Navigating The Year 2026 A Comprehensive Guide To Calendars For The The child tax credit (ctc) and additional child tax credit (actc) are credits for individuals who claim a child as a dependent if. Here's a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to.

Source: vanguskubary.pages.dev

Source: vanguskubary.pages.dev

Irs Calendar 2025 Direct Deposit V Angus Kubary Key changes to the child tax credit (ctc) the child tax credit (ctc) will be $2,200 per qualifying child for the 2025 tax year. Income thresholds determine how much a taxpayer could earn for the year before they no longer qualify for the ctc.

Source: victorjmckinneyj.pages.dev

Source: victorjmckinneyj.pages.dev

Ctc Calendar 2025 Irs.Gov Victor J. McKinney Ctc payments 2026 schedule brings innovative changes to the way families receive financial assistance through the child. You can claim the child tax credit by entering your children and other dependents on form 1040, u.s.

Source: suncatcherstudio.com

Source: suncatcherstudio.com

Free Printable 2026 Yearly Calendar DIY Projects, Patterns, Monograms In 2026, the earned income threshold will be $3,000 regardless of the number of children for which the ctc is claimed. The child tax credit (ctc) and additional child tax credit (actc) are credits for individuals who claim a child as a dependent if.

Source: victorjmckinneyj.pages.dev

Source: victorjmckinneyj.pages.dev

Ctc Calendar 2025 Irs.Gov Victor J. McKinney You can claim the child tax credit by entering your children and other dependents on form 1040, u.s. Here's a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to.

Source: maudeqmercedes.pages.dev

Source: maudeqmercedes.pages.dev

Ctc Price List 2024 Calendar Dehlia Keelia Ctc payments 2026 schedule brings innovative changes to the way families receive financial assistance through the child. Income thresholds determine how much a taxpayer could earn for the year before they no longer qualify for the ctc.

Source: doreneycornelia.pages.dev

Source: doreneycornelia.pages.dev

Ctc Calendar 2025 Irs Pdf Saba Roxine Here's a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to. In 2026, the earned income threshold will be $3,000 regardless of the number of children for which the ctc is claimed.